It's a widely-held misconception that those with good credit have a better grasp of managing their finances

It's a widely-held misconception that those with good credit have a better grasp of managing their finances. In a recent consumer survey from Marcus by Goldman Sachs®*, 34 percent of consumers with good credit (FICO 660 and above) are in credit card debt and 41 percent view credit card debt as an area they wished they had more control over. Even those with good or excellent credit -- a score of 660 FICO or above -- can be prone to the cycle of high-interest credit card debt that includes variable interest rates and hidden fees. It's enough to make anyone feel like debt resolution is out of reach.

For most of the population, it's much easier to get into debt than it is to get out of it. According to NerdWallet's 2016 American Household Credit Card Debt Study, the average household with credit card debt has balances totaling $16,748**. Everyday expenses and unexpected costs like braces for the kids, a leaky roof or a hot water heater breaking can affect everyone. For many, it's easy to fall behind and resort to high-interest credit cards as a solution. Debt, particularly credit card debt, can be deeply stressful for people carrying a seemingly endless balance month over month. This stress, combined with the deep-rooted stigma around talking about credit card debt, leaves many people feeling like they have limited options to help them better manage their finances.

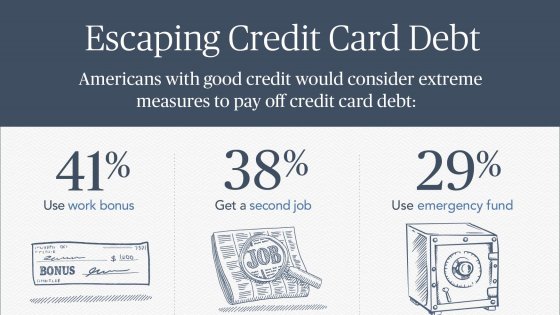

The consumer survey by Marcus by Goldman Sachs also uncovered surprising numbers surrounding the struggles Americans with good credit have with credit card debt. Many are unaware of alternative options that can help address their credit card debt and turn to increasingly desperate measures for assistance. Thirty-four percent would consider selling off household items to help with payments and 38 percent would consider turning to a second job.However, there are other solutions that can help eliminate the revolving cycle of credit card debt.

One viable alternative is a fixed-rate, no fee personal loan, available from Marcus by Goldman Sachs. Loans range from $3,500 to $30,000 to eligible consumers with good or excellent credit (FICO 660 and above). Loan terms range for three to six years and interest rates range from 6.99 percent to 23.99 percent.Marcus offers U.S.-based dedicated loan specialists who deliver live, personalized support. On Marcus.com you can also find a savings calculator to help you estimate your savings over high-interest variable credit card debt without affecting your credit score.

So, explore your debt management options -- whether you want to consolidate debt, or simply need a loan that works for you.*The Marcus by Goldman Sachs Debt Survey was conducted between November 9 and November 16, 2016 among 1,000 nationally representative Americans ages 22 and over, using an e-mail invitation and an online survey.

**NerdWallet's 2016 American Household Credit Card Debt Study is based on data from the Federal Reserve Bank of New York and the Census Bureau.